Best Of The Best Tips About How To Build A Bond Ladder

In this video we compare jim and jill’s bond portfolios to highlight some advantages of bond ladders, such as their ability to mitigate various types of risk.

How to build a bond ladder. How is a bond ladder created? A bond ladder won’t get you there, but it can help provide financial security later in this life (not, alas, in the next). Hold bonds until they reach maturity.

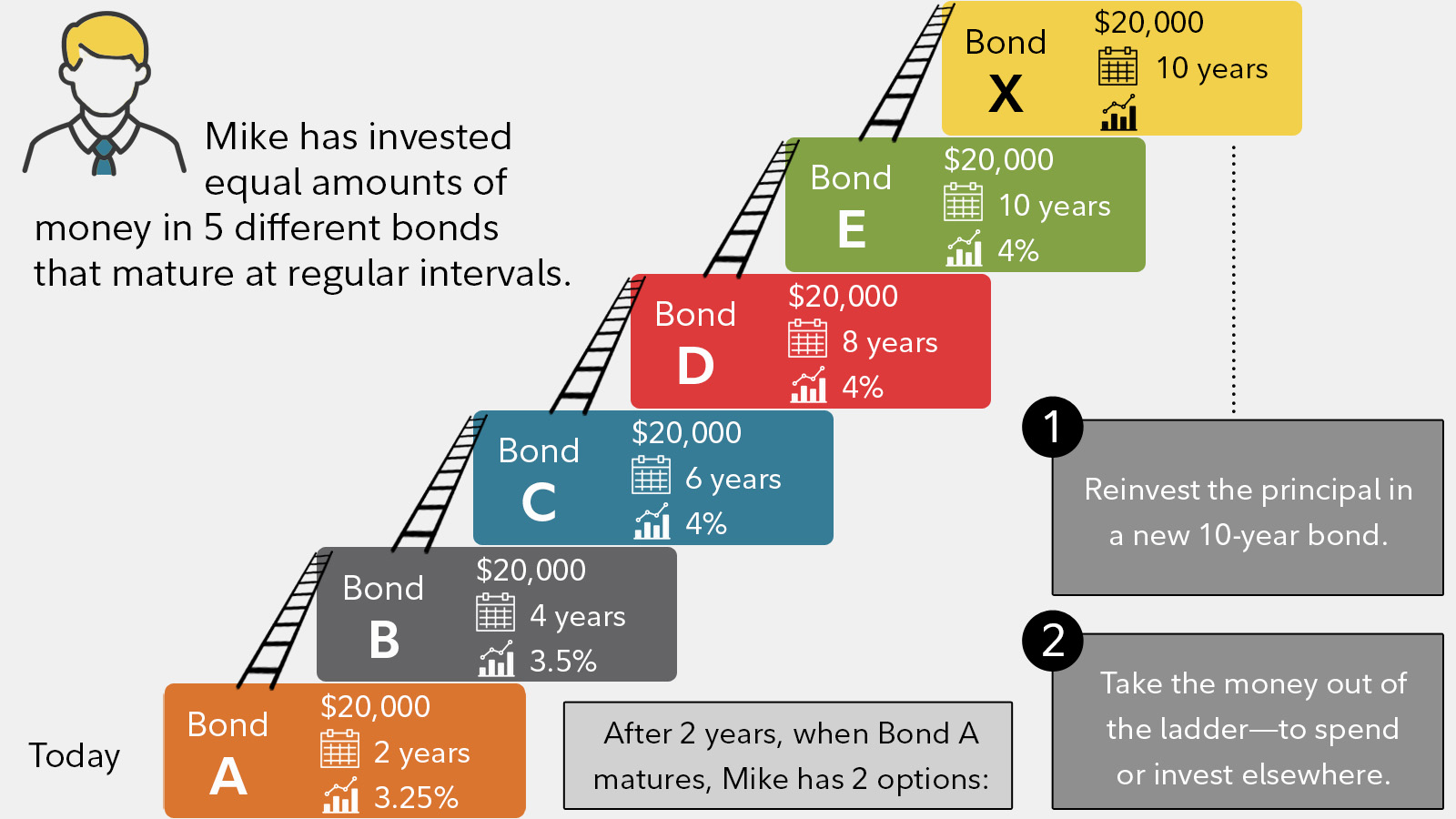

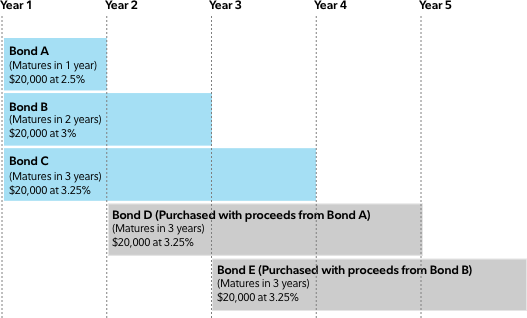

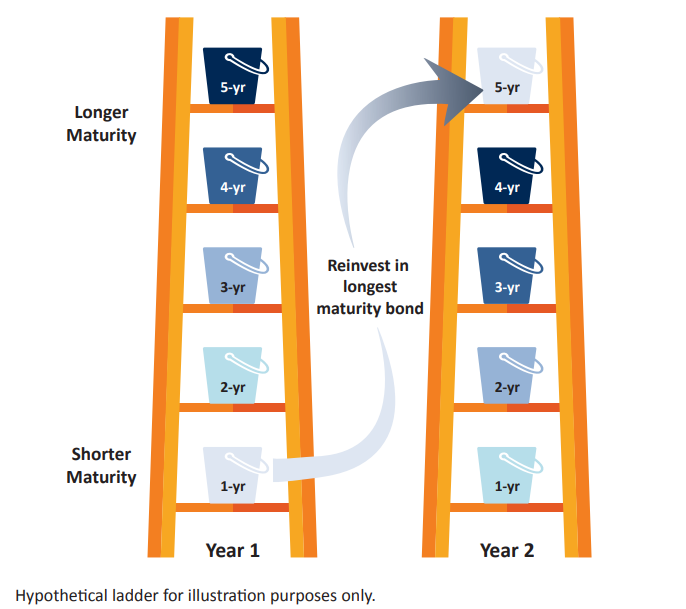

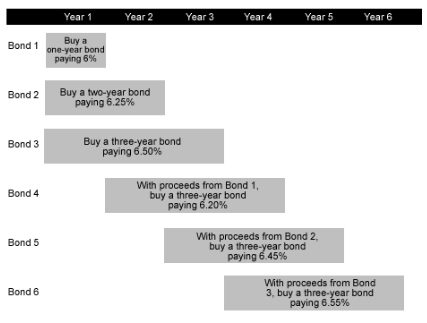

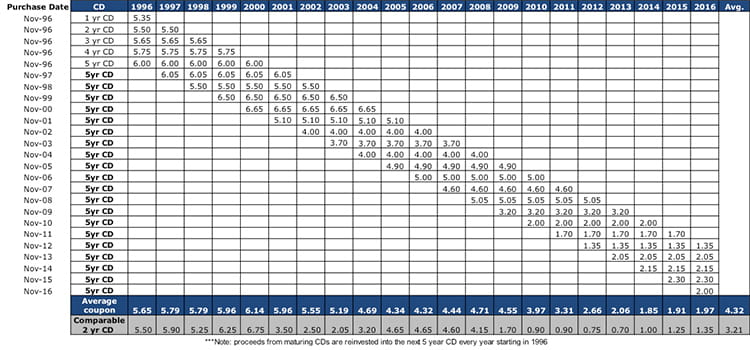

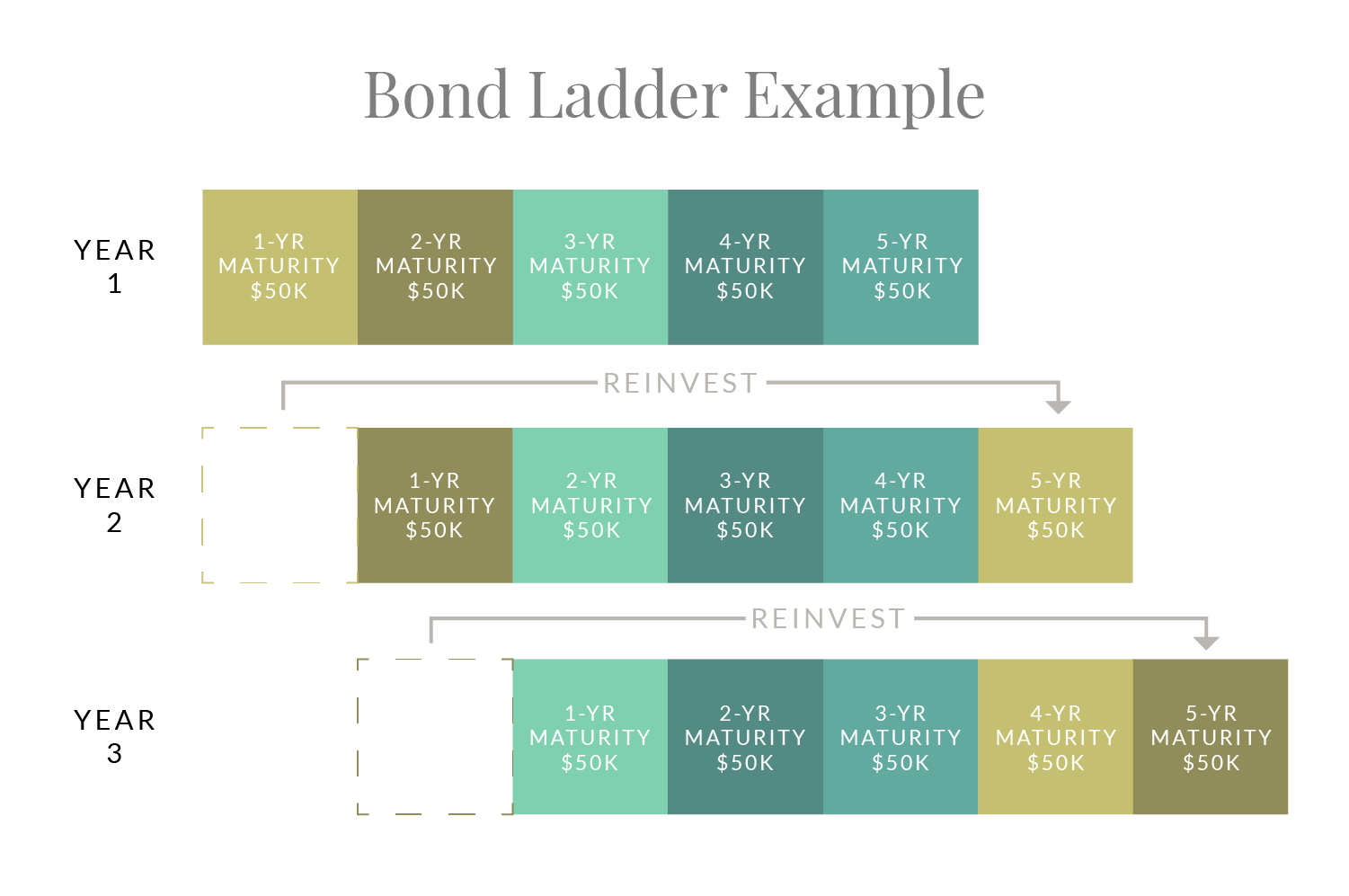

You set the time frame, choose the funds and decide how much money to put in each ladder rung as a percentage of the portfolio. The distance between rungs is. To make a bond ladder successful, he says investors need to hold their bonds to their maturity as selling early messes up the income flow.

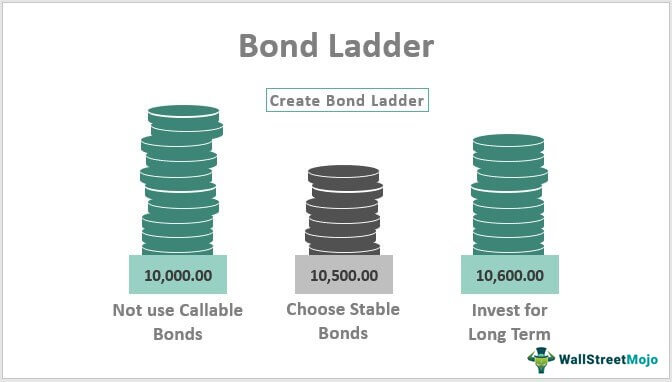

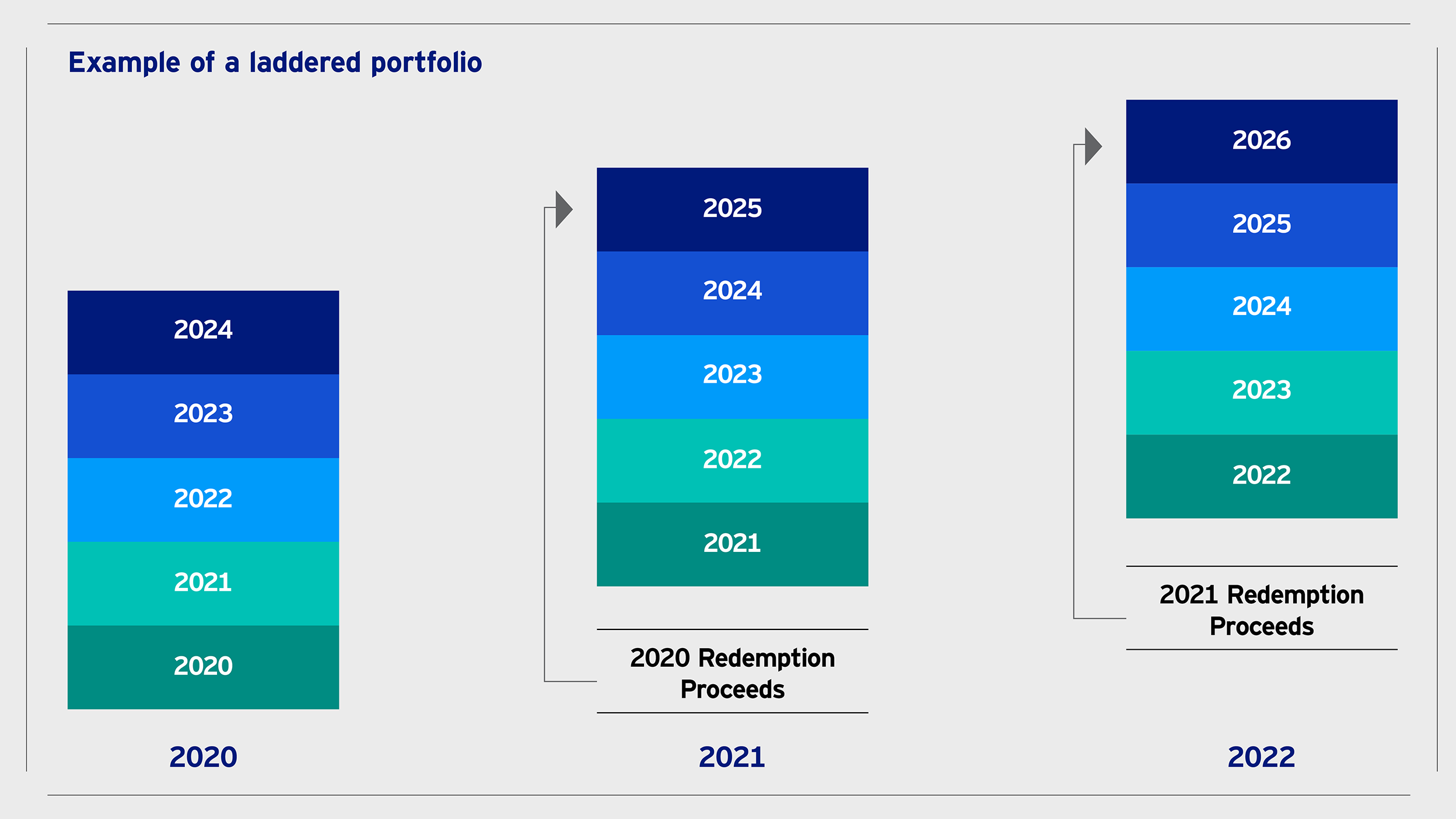

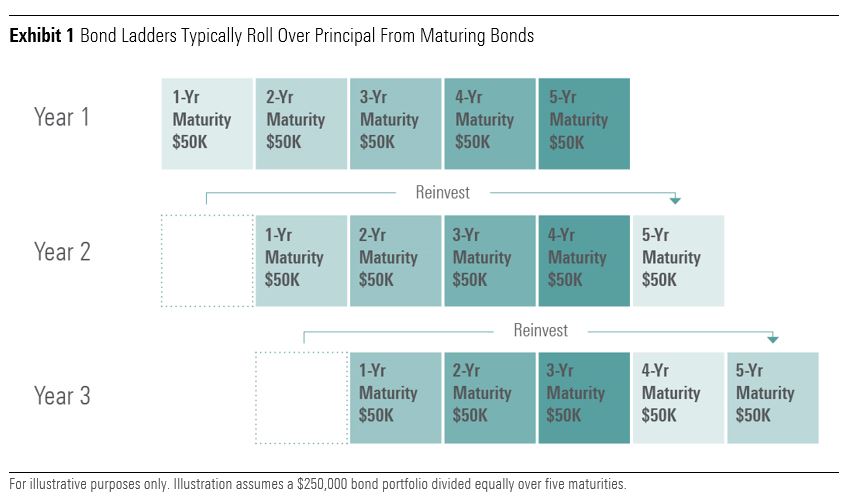

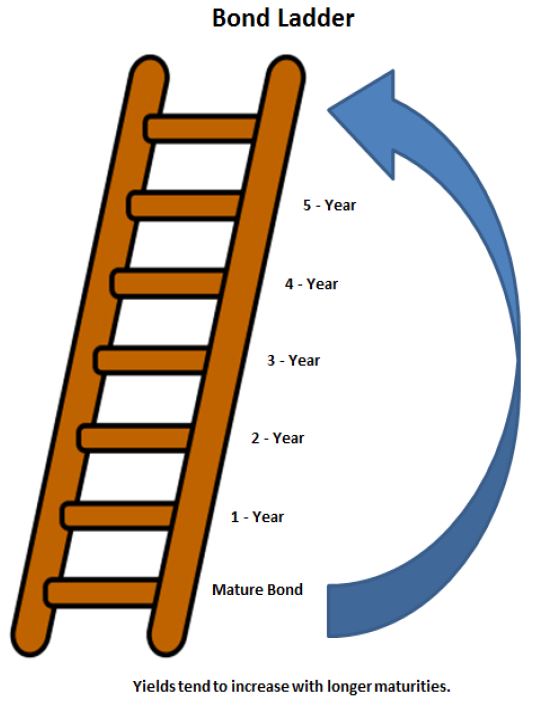

A laddered etf concentrates its holdings on bonds with varying maturity dates. Log onto the treasury direct. As the ones at the front of the ladder mature, you use the principal to buy new bonds at the.

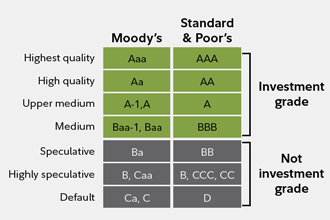

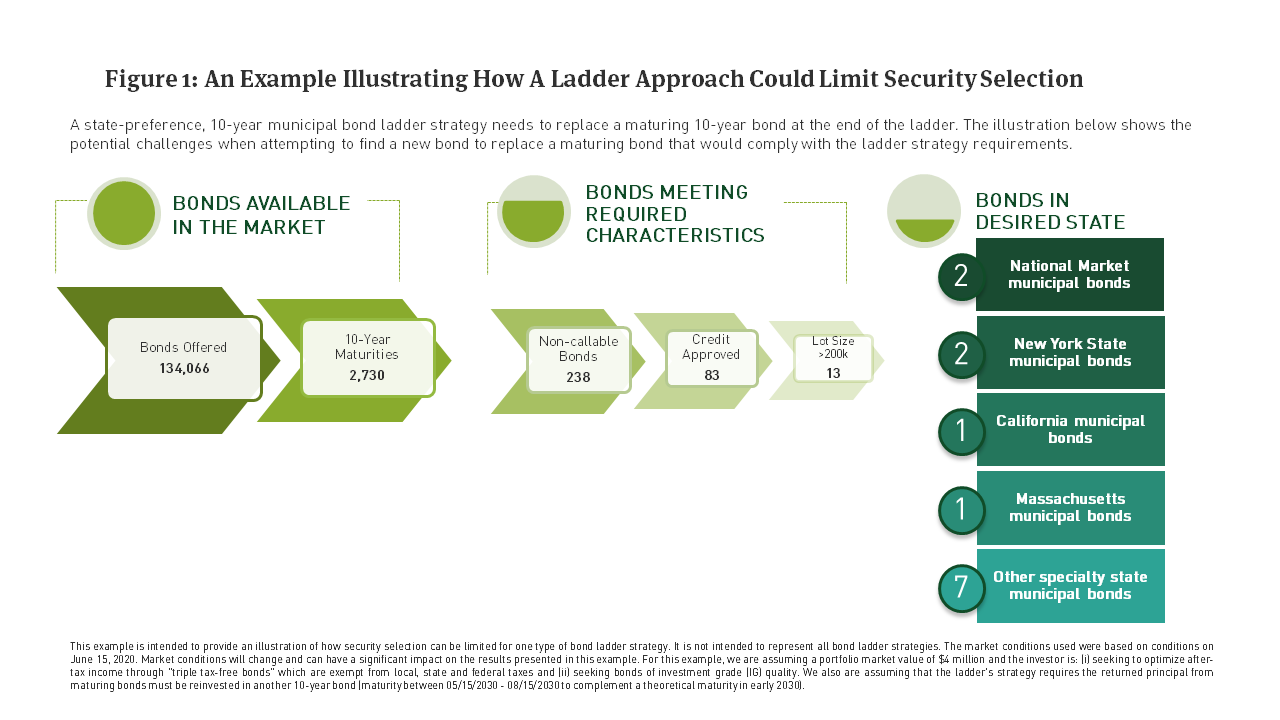

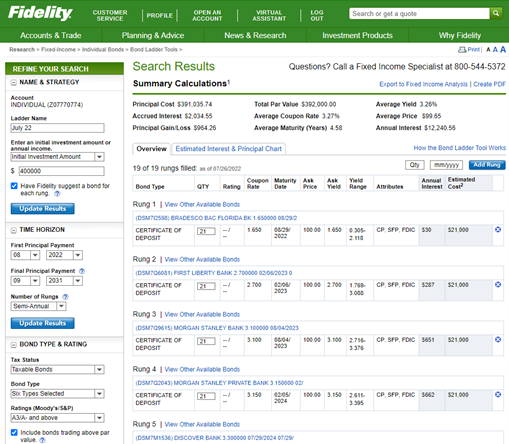

How many issuers might you need to manage the risk of default? Discover a more convenient way to build bond ladders. All with a different defined maturity date.

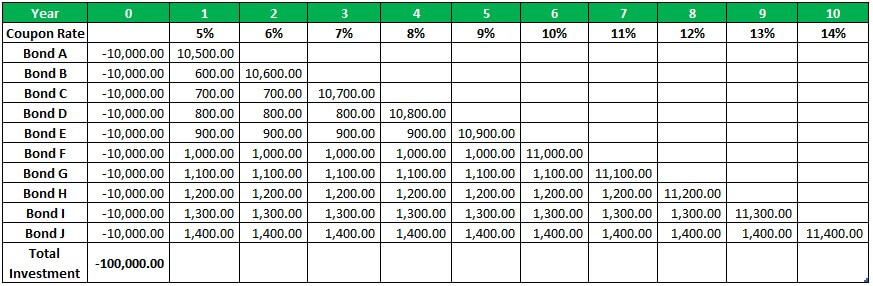

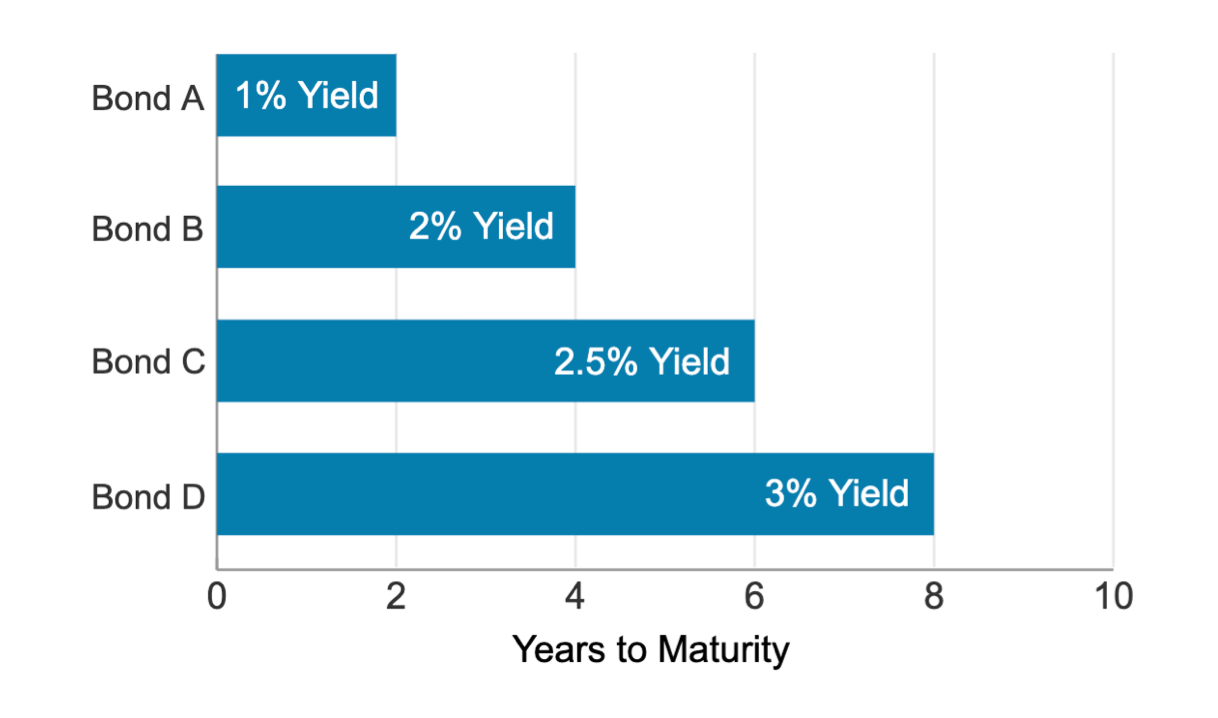

The first step is determining the total number of rungs you’ll need. Investors need to make sure the. To create a bond ladder, you buy individual bonds with staggered maturity dates.

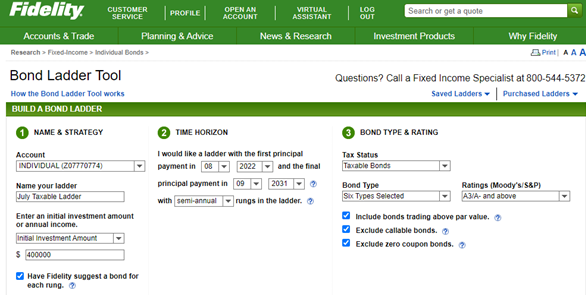

How and why to build a bond ladder 1. To maintain the ladder,the proceeds would be re. On step 1, you'll choose to begin with a predefined or custom ladder, select your account, and initial investment.