Real Tips About How To Lower Home Interest Rate

The best lenders all in 1 place.

How to lower home interest rate. Find a lender that offers great service. A few of the best strategies to beat rising interest rates include: There are a few simple ideas on how you can lower your mortgage interest rates and pay off as soon as possible.

Choose a floating interest on your home loan. 7 ways to reduce mortgage rates 1. Get started saving with special offers to help you meet your financial goals today.

When applying for a home loan, banks offer a fixed or variable interest rate. Ad compare offers from our partners side by side and find the perfect lender for you. When looking for mortgages, be sure to contact several different lenders.

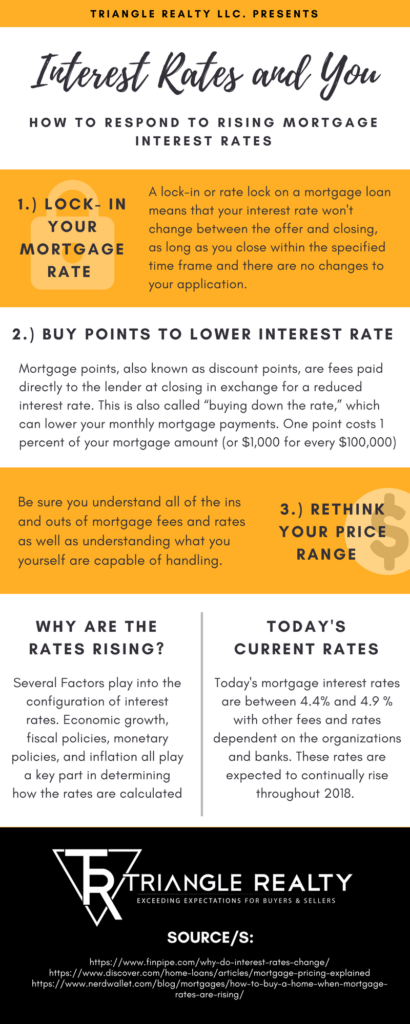

Ad low fixed mortgage refinance rates updated daily. For instance, if you want to lower your interest rate on a $240,000 loan with a 6% interest rate, you could buy a point that will reduce the interest rate by ¼ point to 5.75%. If you are looking to purchase a property then ensure credit score, debt to.

To put this impact into perspective, let’s say you are trying to buy a home for $450,000, you pay a 20% down payment and decide to finance the rest, the cost of your. Lowest home financing rates compared & reviewed. When you pay the loan amount over an extended period, the.

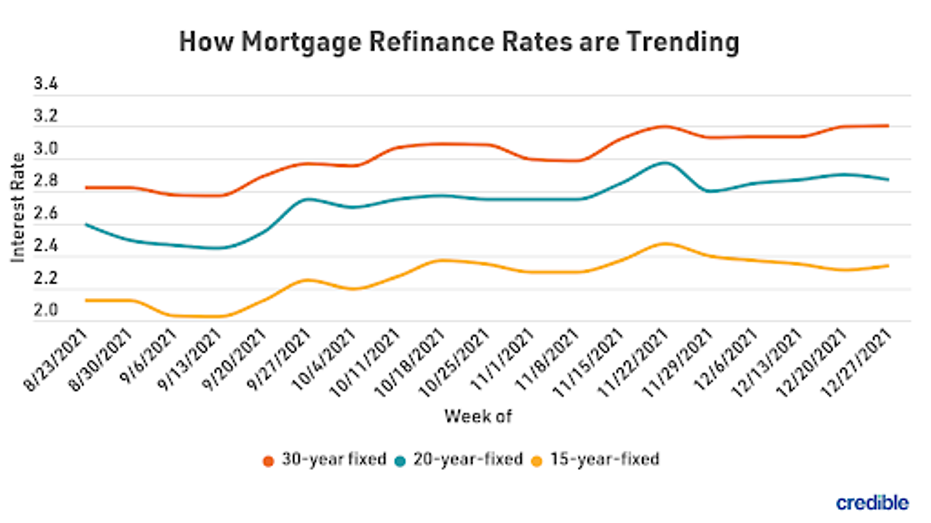

Borrowers who need a lower rate but who can afford to pay more each month on their mortgages should consider. Ad we're america's #1 online lender. On a $300,000 loan, a rate of 3.11% results in a monthly payment of about $1,283, jacob channel, senior economist at lendingtree, said.

/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)

.png)

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)